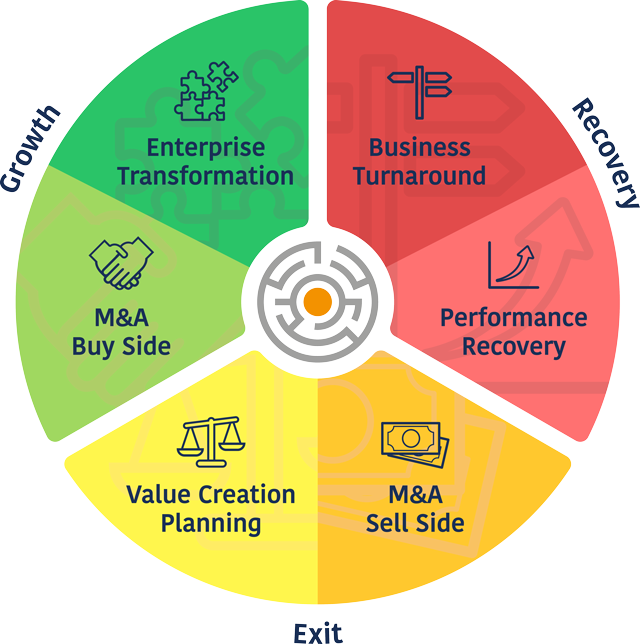

Every business is on a journey — but not always the same one. Pilgrim supports leaders through six distinct paths designed to recover performance, create value, or drive growth.

Our 6-segment model recognises that no two situations are alike. Some organisations need to stabilise and rebuild confidence. Others are preparing to realise value. Many are ready to expand and transform. Each journey demands focus, pace, and practical experience — and that’s where Pilgrim excels.

We work across:

Wherever you are in your journey, Pilgrim brings clarity, structure, and action — helping you move forward with confidence. Click on the segments below to learn more.

In a volatile market, performance decline can escalate quickly — threatening not just profitability, but the viability of the enterprise itself.

In a business turnaround, the 30-day plan isn’t about perfection — it’s about control, confidence, and momentum. Our goal is to stop the slide, stabilise cash, and reset priorities. Here’s a practical outline of the key components our 30-day turnaround plan covers:

When performance stalls, Pilgrim brings the clarity and discipline to get it moving again.

Whether it’s quality, delivery, cash, or margin, our focus is on cause, control, and correction — fast.

We start by pinpointing the drivers behind the issue: analysing data, mapping processes, and exposing where time, money, or effort is being lost. From there, we create a focused 30-day recovery plan that brings the numbers back on track — clear priorities, rapid interventions, and visible results.

Our approach is hands-on and practical:

Pilgrim’s role is to get the business back in control — and build the discipline to keep it there.

We deliver fast, pragmatic solutions that stabilise performance and create the conditions for long-term success — turning challenge into momentum.

No one wants to leave money on the table — especially when it’s taken years to build.

We like to get involved early in the Sell Side process — when there's still time to influence the levers that affect valuation. That means shaping the operational story behind your Quality of Earnings report and helping ensure post-deal adjustments are minimised.

Whether you're a founder planning retirement or a PE partner approaching exit, success comes down to focus — and preparation. We focus on five key drivers to sharpen your edge and strengthen buyer confidence:

When it comes to selling your business, details matter — and value lives in the operations. We make it clearer, cleaner, and more valuable — so you attract the right buyers and close with confidence.

In Private Equity-backed businesses, a well-crafted Value Creation Plan is more than a document — it’s the backbone of a successful exit.

We support your operational and commercial teams in four key areas:

Pilgrim ensures the Value Creation Plan moves from strategy to reality — positioning the asset for maximum valuation and a confident handover.

Acquiring a business is a significant investment that demands careful consideration and strategic planning. Our Buy Side Support is designed to ensure you make informed decisions and achieve successful integrations both now and in the future.

Let us partner with you through every phase of your acquisition journey, enhancing your ability to make strategic investments that drive growth and success.

When a business is ready to grow, Pilgrim delivers the systems, disciplines, and culture that make it happen.

We don’t chase efficiency for its own sake — we build enterprise-wide capability. Drawing on our deep experience in Lean Manufacturing, the Toyota Production System, and Operational Excellence, we embed continuous improvement and performance alignment from the shop floor to the boardroom.

Our approach connects strategy to execution through three lenses:

This is transformation that endures — grounded in practical methods, proven results, and a culture of continuous improvement.

Let’s have a no-obligation conversation and explore what’s possible.